1. Stop wasting money on overpriced car insurance

Car insurance is likely taking a big chunk out of your monthly budget, but it could be keeping you safe for less. Insurance companies tend to pile on confusing add-ons and lingo, which leads you to pay more than necessary.

OfficialCarInsurance.com lets you compare quotes from trusted brands, such as Progressive, Allstate and GEICO to make sure you're getting the best deal.

You can switch to a more affordable auto insurance option in 2 minutes by providing some information about yourself and your vehicle and choosing from their tailor-made results.

Find offers as low as $29 a month.

2. Protect your loved ones with term life insurance

When planning for the future and ensuring financial security for your loved ones, life insurance plays a crucial role.

Term insurance is a type of life insurance that offers coverage for a predetermined period, known as the "term," that typically ranges from 10 to 30 years. If the insured individual dies during this term, the policy pays a death benefit to the designated beneficiaries. Term insurance is usually a less expensive and more flexible option.

Young families and busy professionals looking for fast and affordable insurance can easily connect with Ethos and get term life insurance in 5 minutes, with no medical exams or blood tests.

With Ethos Insurance, you get a policy with up to $2 million in coverage, starting at just $2/day. Ethos’ application process ensures you get flexible coverage options quickly and transparently, allowing you to focus on what matters most.

3. Secure your retirement with a gold IRA

Gold has long been touted as a safe-haven asset—and it can go a long way toward building your retirement portfolio. The precious yellow metal offers more stable returns than stocks, especially during market volatility and recession.

You can open a gold Individual Retirement Account (IRA) with American Hartford Gold to reap tax advantages while investing directly in physical precious metals. Plus, if you already have an IRA, rolling it over to American Hartford Gold is completely free, and you’ll get up to three years of complimentary storage, maintenance, and insurance.

Get your free information guide to learn how to get started and earn up to $15,000 in free silver with qualifying purchases when you join American Hartford Gold.

4. Automatically invest your spare change

Acorns is an investing service and savings tool rolled into one.

When you make a purchase on your credit or debit card, Acorns automatically rounds up the price to the nearest dollar and places the excess — the coins that would wind up in your pocket if you were paying cash — into a smart investment portfolio.

Let’s say you purchase a doughnut for $2.30. Before you’re done licking the sugar off your fingers, Acorns will round the amount to $3.00 and invest the 70-cent difference for you. That’s all there is to it.

Your spare change may not seem like much, but look at this math: $2.50 worth of daily round-ups add up to $900 per year — and that’s before your savings earn money in the market.

Plus, if you sign up now you can get a $20 bonus investment.

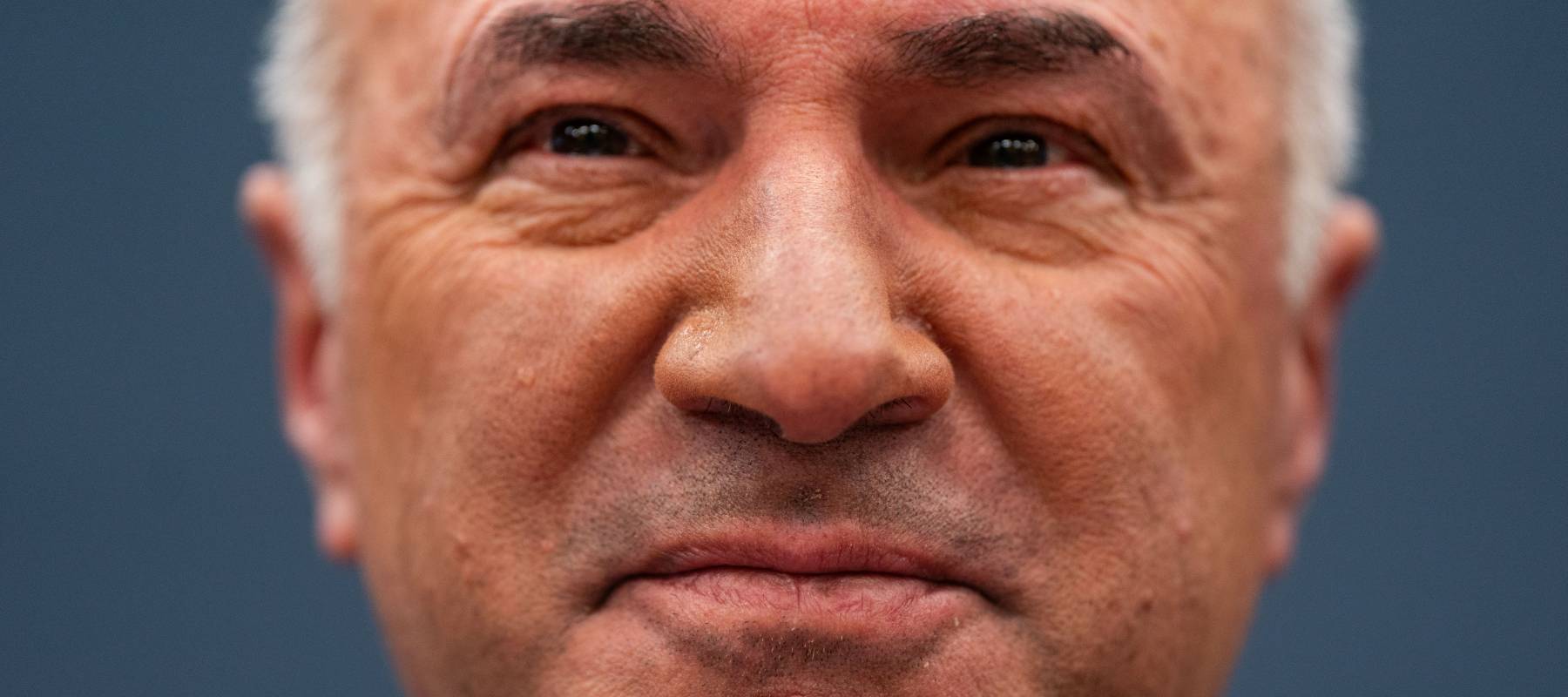

5. Get help from a trusted advisor to create a wealth-building plan for retirement

Secure your financial future with confidence through a personalized plan designed to optimize investments, navigate taxes, and ensure a comfortable retirement.

Finding a financial advisor that suits your specific needs and financial goals is simple with Vanguard.

Vanguard’s hybrid advisory system combines advice from professional advisers and automated portfolio management to make sure your investments are working to achieve your financial goals.

With a minimum portfolio size of $50,000, this service is best for clients who already have a nest egg built and would like to try to grow their wealth with a variety of different investments. All you have to do is set up a consultation with a Vanguard advisor, and they will help you set a tailored plan and stick to it.

- Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing. This marketing was vetted by the Moneywise team and sponsored by the Fundrise Flagship Fund.